Liquidity & Technology

Access to Deep Tier1 Bank, Hedge Fund and Broker Liquidity, Tight Spreads and Low-Cost Execution fees in over 250+ Financial Market Instruments

open Account

Pro-active Liquidity Management Team

Equipped with optimisation tools & reports to improve execution quality.

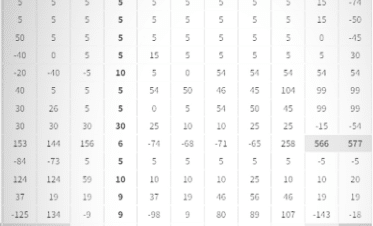

Spread Monitoring Reports

Active price reviews and monitoring of all LP’s pricing 2-way streams.

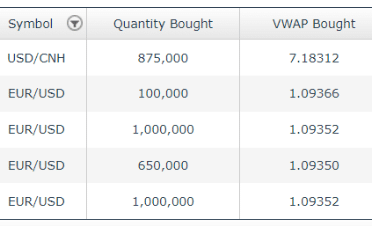

Trade Mark-out Analysis

Open communication and guidance on full trade execution summary.

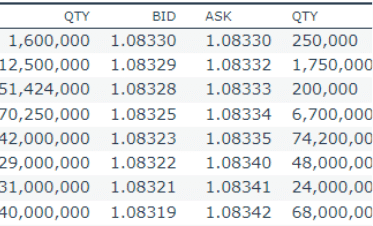

Tailored Liquidity Streams

Full amount feeds to reduce market impact and tight TOB sweepable feed.

New Product at MAS Markets

Prime Brokerage services

Access a range of services traditionally reserved for major institutions.

Net Open Positions & Leverage

Competitive Margins Starting from 1:50 and NOP’s based on deposit amount.

Eligible Client Criteria

Estimated $100m ADV with minimum deposit amount of $200k.

Clearing Costs

MAS Markets charges a separate clearing fee based on estimated monthly volumes.

Connectivity

Multiple connectivity options available which includes MAS Trader.

Venue Fees & Market Data/FIX sessions

Invoiced per venue and pre-agreed prior to onboarding new venue.

Trading Products

Spot Foreign Exchange & Metals instruments which are cleared.

Net Open Positions & Leverage

Competitive Margins Starting from 1:50 and NOP’s based on deposit amount.

Eligible Client Criteria

Estimated $100m ADV with minimum deposit amount of $200k.

Clearing Costs

MAS Markets charges a separate clearing fee based on estimated monthly volumes.

Connectivity

Multiple connectivity options available which includes MAS Trader.

Venue Fees & Market Data/FIX sessions

Invoiced per venue and pre-agreed prior to onboarding new venue.

Trading Products

Spot Foreign Exchange & Metals instruments which are cleared.

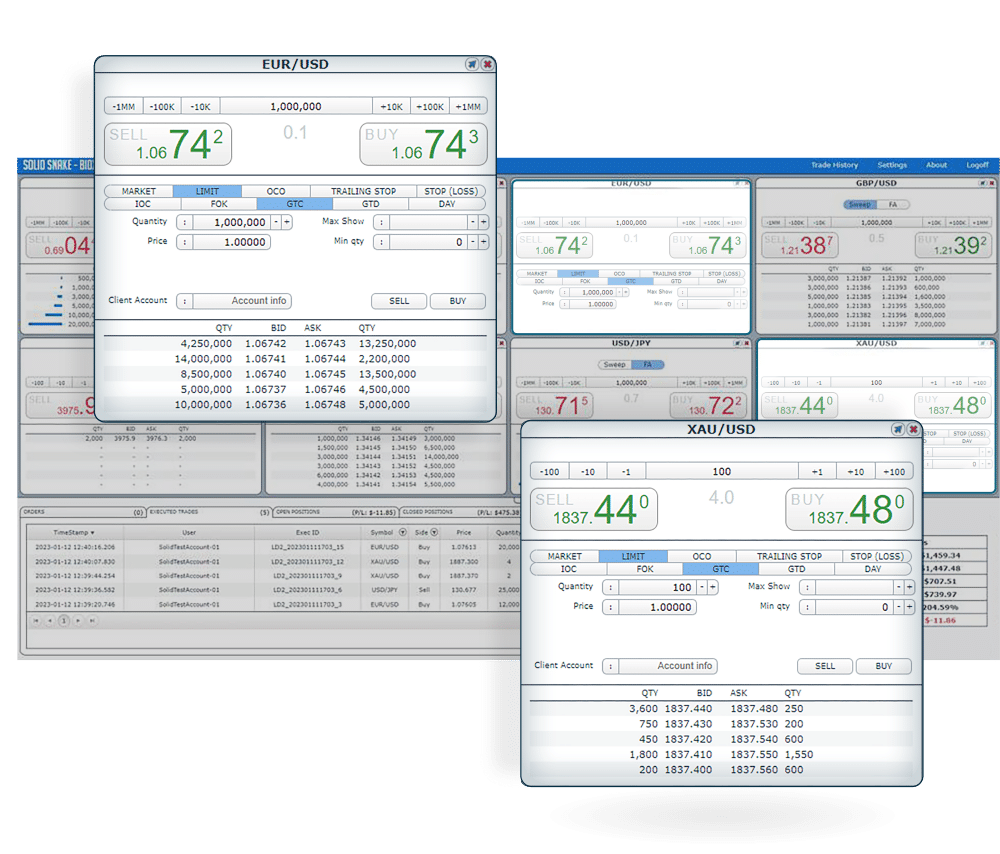

Platforms at MAS Markets

Secure, Reliable & User-Friendly Web-Based Trading Platform

Simple to setup, intuitive to use, multiple order types.

MAM/PAMM Managed Account Solutions

Advanced post-trade allocation tools for regulated portfolio Managers.